Experts warn oil and gas can’t save Louisiana’s economy — even under Trump

As state lawmakers consider even more tax breaks for fossil fuels, a new report says the state can no longer rely on the industry for growth

Published by Louisiana Illuminator

President-elect Donald Trump has promised to lift roadblocks to oil and gas production and approve construction of more than a dozen liquefied natural gas terminals in Louisiana and elsewhere.

At the same time, a special session in the Louisiana Legislature that began Nov. 6 seeks to cut state taxes for oil refineries and petrochemical companies. The state’s generous property tax exemption for industry won’t be touched.

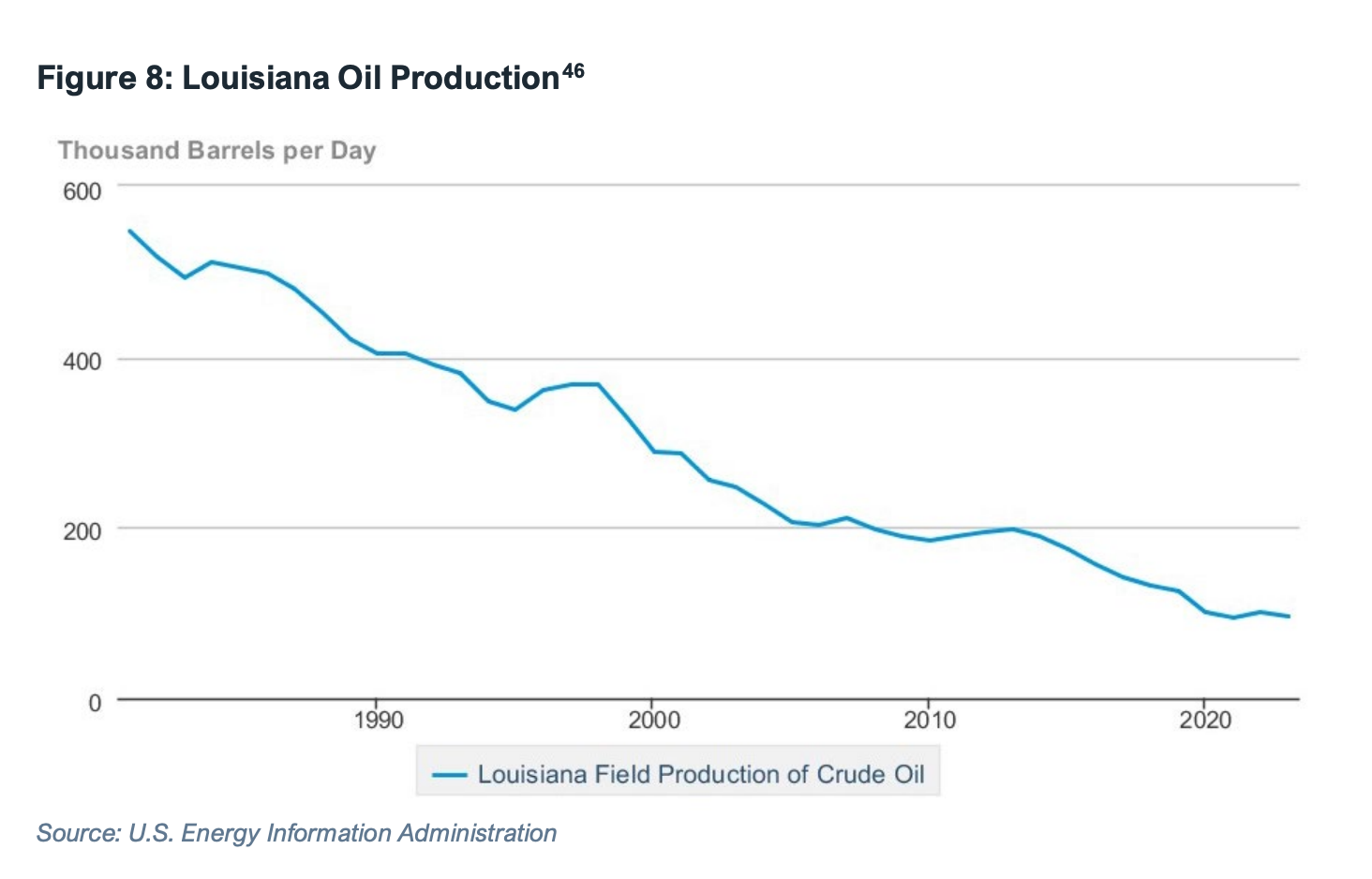

But a new report and long-time observers of the state’s economy say continuing to expect the oil and gas industry to provide an economic renaissance in Louisiana is unrealistic. Not only do those industries no longer drive Louisiana’s economy — providing just 4.5% of state revenue, compared with 40% in the late 1990s — but slowing global demand for those commodities is poised to further diminish the industry’s benefits to the state.

Louisiana’s growth trajectory is less like most of its neighboring states and more like Puerto Rico, which has experienced negative or very small economic growth in recent years, said Tom Sanzillo of the Institute for Energy Economics and Financial Analysis (IEEFA) and an author of the report titled “The Declining Significance of the Petrochemical Industry in Louisiana.”

“At the turn of the 21st century, Louisiana had one of the country’s fastest-growing economies, placing sixth among the states for five-year average gross domestic product (GDP) growth”, according to the report. “Today, Louisiana is 49th out of 50 states in GDP growth. It also ranks 49th in population growth and 45th in median household income.”

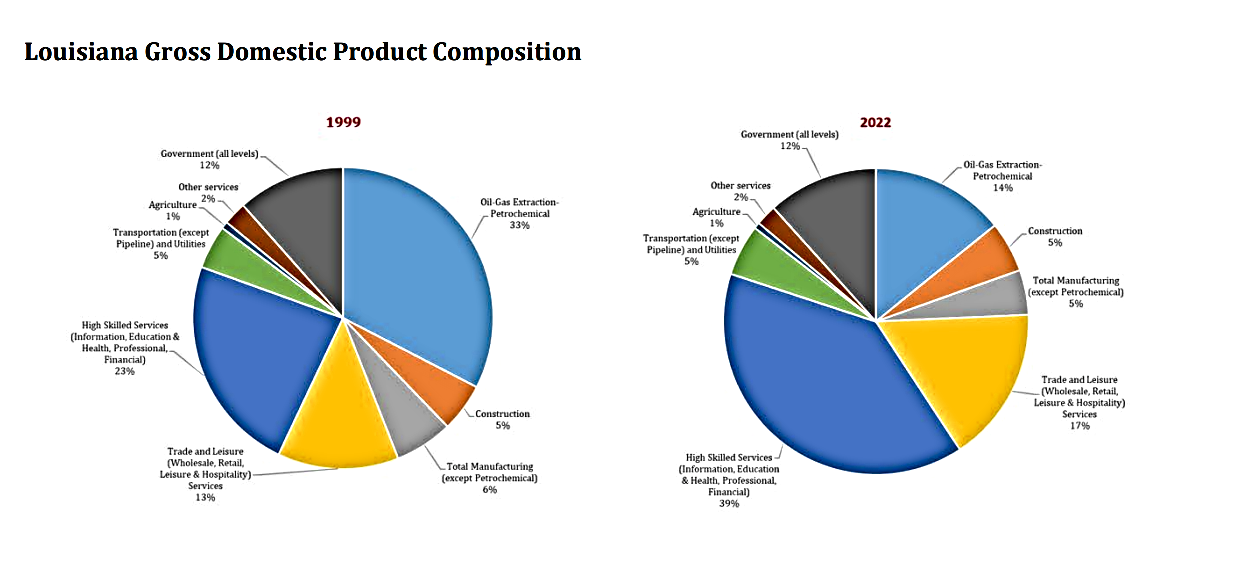

The report also notes that in 1999, the oil and gas sector accounted for 33% of the state’s GDP. By 2022, it had sunk to 14%.

“I mean, we're reviewing stuff all over the world now,” Sanzillo said. “And I looked at that, and I said, ‘That can't be right. This is stunning.’ ”

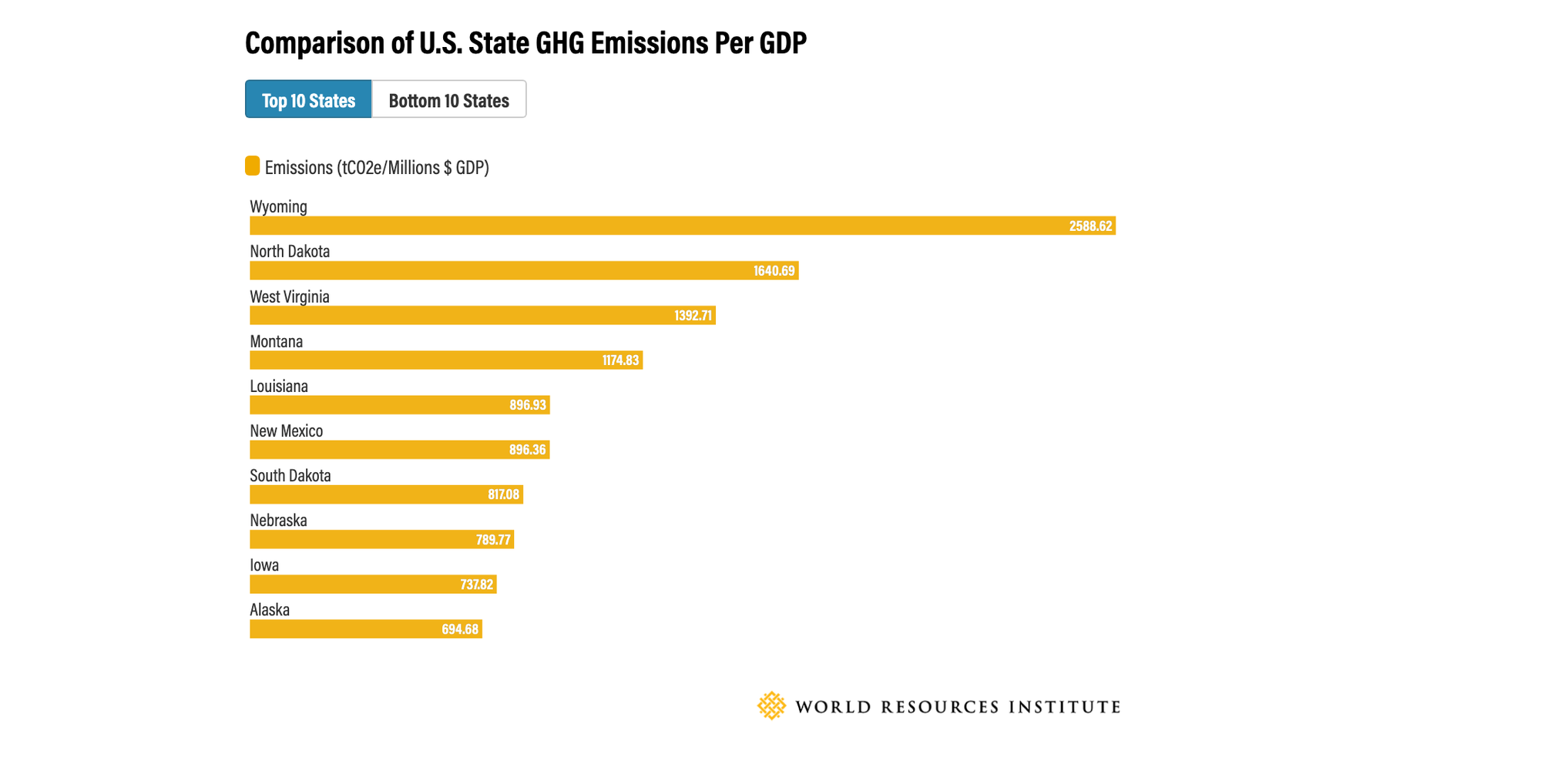

State a leader in fossil fuel emissions

Because of its ties to fossil fuels — either through production of natural gas and oil or by burning it and using it at petrochemical plants — Louisiana is the sixth largest emitter of carbon dioxide, a major greenhouse gas, in the United States.

And Louisiana is the second most vulnerable state to climate change caused by those emissions — prone to stronger hurricanes, rising sea levels and increasing heat and rainfall.

“The oil and gas industry has a hold on the popular imagination, our self-image and our politics that is way disproportionate to their actual economic impact and their impact on actual communities,” said Jan Moller, executive director of the Invest in Louisiana, a nonpartisan economic think tank.

The IEEFA report says the state must diversify its economy to thrive, a conclusion echoed by a Moody’s Investor Service report that warned earlier this year of “revenue volatility stemming from (Louisiana’s) financial and economic dependency on oil and gas extraction and refining.”

Louisiana State University economics professor emeritus Jim Richardson agrees the state must diversify. He served 30 years as the economist on the Louisiana Revenue Estimating Conference, the state’s economic forecasting panel.

“We’re an oil and gas state, but, well, we need to be more than that,” Richardson said.

Petrochem sector already saturated

Sanzillo says even a Trump administration can’t change worldwide markets. Global supply of some of the chemicals produced in Louisiana is already exceeding worldwide demand, according to the report.

While it provides an overall picture of oil, gas and petrochemical production in Louisiana, the report focuses specifically on two substances: ethylene, a building block for other chemicals and plastics, and methanol, which is used for fuel and to make plastics, paints and cosmetics. Both substances are made using fossil fuels as feedstock.

Industrial capacity to manufacture ethylene exceeded demand for the substance by an annual average of 17 million tons from 1990 through 2023, according to the Independent Commodity Intelligence Service. Ethylene capacity is expected to exceed demand over the next six years by 53 million tons, according to the same source.

The IEEFA report examined 24 petrochemical projects in Louisiana in various stages of development. Of those, 61% are ethylene or methanol plants, with investments totaling $82 billion. Those plants have been approved for $6.8 billion in property tax breaks through the state’s Industrial Tax Exemption Program (ITEP).

State sees future in oil, gas and petrochem

Louisiana Economic Development, a state agency, looks at some of the same petrochemical projects cited by IEEFA and sees evidence that the industries themselves are diversifying, benefitting the state’s economy.

“Diversification and innovation in Louisiana’s energy sector has been well documented, and nationally recognized,” LED spokesman Mark Lorando said. “Since 2018, companies have committed more than $61 billion of capital investment in a wide variety of new energy projects across the state, representing the potential creation of more than 26,000 direct and indirect jobs.”

He added, “Many of these companies, including our legacy energy industry, are implementing innovative technologies in renewable fuels and blue hydrogen, as they capitalize on a workforce skilled in energy production.”

At least a third of the projects highlighted by LED will rely on carbon capture and sequestration (CCS). Sanzillo’s group and others say CCS is “unproven and expensive.”

The oil, gas and petrochemical sector also are not the job creators they once were. Currently, oil, gas and related industries employ 45,000 people, according to LED — fewer than 3% of the state’s 2 million workers. Another 260,000 have jobs indirectly associated with the industry. As recently as the 1980s, more than 120,000 people were directly employed by the industry.

Part of that decrease is from automation at chemical plants. “Our industrial capacity can grow, but the number of people working there does not necessarily grow at the same rate. And again, is that bad from a company perspective? Are they trying to be mean to us? No, they're merely trying to be competitive in a worldwide economy,” Richardson said.

Engineers are often the primary employees at the petrochemical plants, not blue-collar line workers, Moller said. “These aren’t your parents’ factories.”

Deep tax cuts for industry eyed

Under Landry’s tax plan, some corporations would have their income taxes more than cut in half — from a maximum 7.5% to 3%. A franchise tax, which is imposed on a business’ net worth, would be eliminated. Louisiana is one of 18 states and the District of Columbia that levies a franchise tax.

But Moller points out that “Louisiana already has the most generous corporate, manufacturing incentive anywhere in the country … in ITEP. Now we are going to cut back the two taxes that we do get,” Moller said. Under ITEP, manufacturing industries — including those manufacturing chemicals — are exempt from paying 80% of their property taxes for up to 10 years.

Landry's plan proposes the state make up for the loss of corporate taxes through a variety of measures, such as cutting incentives to the film industry and making permanent a .45 cent increase in sales tax on online products and services, including video streaming services.

Louisiana has the 10th most regressive taxing regime in the nation, putting 13.1% of the tax burden on families making the lowest amount of money, while taxing the richest taxpayers 6.5%, according to the Institute for Taxation and Policy, a nonprofit, nonpartisan tax policy group.

Social contract with fossil fuel industry broken

The state has been grappling for years to find a way to plug the fiscal hole left by tax breaks given to oil and gas industries. Moller said this session won’t fundamentally help.

He noted that Louisiana Gov. Huey P. Long, a populist who served as governor from 1928 to 1932, “struck a social contract with oil and gas that persisted for like, 50 years, and it was basically like, ‘We're going to open ourselves to you.’

“And in exchange, those industries would pay taxes to keep the government operating, and keep taxes low for everyone else. And that was the social contract, and it worked until it stopped working in the 1980s,” Moller said. “We've never seriously figured out how to replace the money that we got from the oil and gas industry for generations.”

In the report, IEEFA calls for something akin to a federal military base closure committee in which government and industry come together to find ways to mitigate the loss of oil and gas revenues and explore new avenues of economic development.

Richardson has watched as three decades of Louisiana governors and politicians worked to attract different industries — including health care, technology and tourism. He says there’s no easy answer to fix the state’s economy.

“Everybody wants to grow and everyone wants to do better,” he said. “I think we’re having a hard time finding that next sector that we can actually grow big time.” But, for the state’s governors, who may only serve four years, “If they want a success story, (energy) is what they are going to do.”

The institute's report points out that many of the projects are being developed in Black communities, including in the corridor between Baton Rouge and New Orleans called “Cancer Alley.”

“Maybe once a long time ago those communities could have claimed big benefits and taxes and … jobs,” Sanzillo said. “Now, they’re just getting a burden.”

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action.