Report: LNG operators in Louisiana offered $21.1 billion in tax breaks

If all 15 liquefied natural gas plants in Texas and Louisiana open, reductions in overall U.S. greenhouse gas emissions would slow

Published by Truthout

The week before Thanksgiving, employees of Cameron LNG handed out turkeys and fixings to residents in southwest Louisiana. Earlier in the month, Cheniere Energy, Cameron LNG, and Venture Global LNG sponsored the Sabine Pass Lighthouse Hayride, helping to revive a local tradition. And Commonwealth LNG pledged more than $1 million to support education and health care in the region.

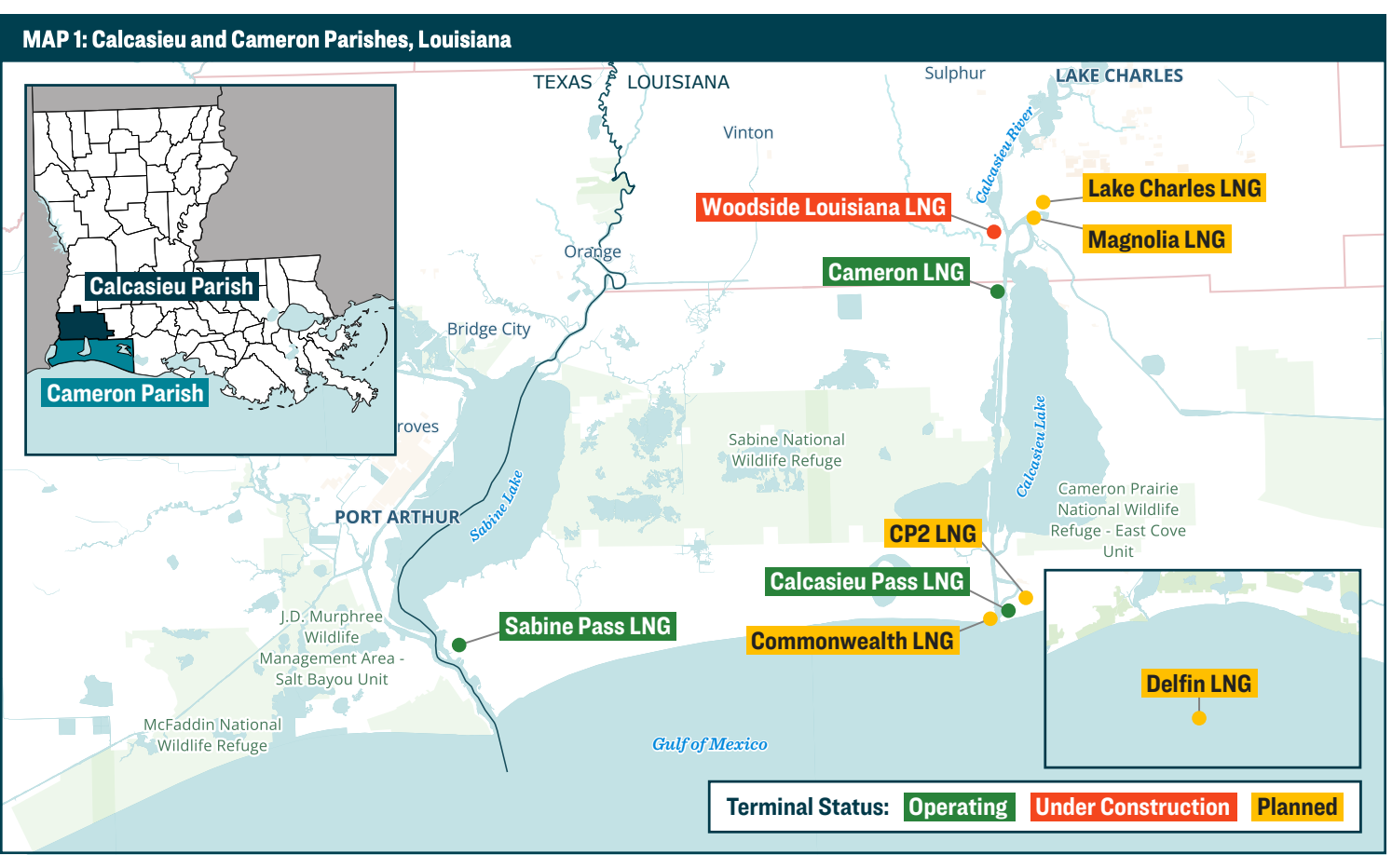

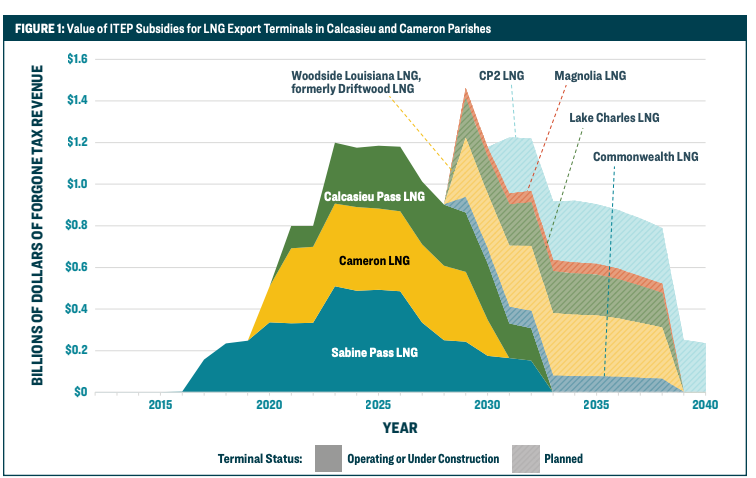

These liquefied natural gas companies can afford to be generous, according to a new report from the Sierra Club. It says Louisiana’s nine operating, under construction and planned liquefied gas terminals are set to receive more than $21.1 billion in local property tax exemptions if all facilities are completed.

The subsidies extended to the LNG industry in Louisiana would double the $20 billion awarded to all of the state’s industry since 1998 through the state’s Industrial Tax Exemption Program (ITEP) according to a 2024 study from the Ohio River Valley Institute, a nonprofit that researches problems primarily in Appalachia.

Those property tax incentives, considered some of the most generous in the nation, amount to an “effective subsidy” of $6.7 million per job at the facilities, according to the Sierra Club.

The report analyzes tax exemptions for the rapidly expanding liquefied gas export industry in Texas and Louisiana. The United States is the world’s largest exporter of superchilled natural gas, with most of the capacity to produce and export the LNG in Texas and Louisiana.

Additionally, if all the planned and under construction LNG terminals are built in the two states, they would undercut about one-third of the greenhouse gas reductions expected to be achieved under the Inflation Reduction Act and through other U.S. actions, the report says.

James Hiatt, founder of the nonprofit advocacy and environmental group, For A Better Bayou, scoffed at the turkey giveaways and other donations the companies provide to Cameron, Calcasieu and Plaquemines parishes where the terminals are being built. He’d rather the communities have the property taxes.

“These deals essentially pay industry to inflict more suffering on already climate-ravaged communities by polluting the air and water while depriving Gulf Coast communities of vital revenue for schools, infrastructure, healthcare, emergency services, coastal restoration and protection,” Hiatt said in the news release accompanying the report.

Louisiana Economic Development, which manages the ITEP program, did not respond to a request for comment.

In a statement, Charlie Riedl, executive director of The Center for LNG, an industry trade group said LNG terminals “support 222,450 jobs, resulting in $23.2 billion in labor income, contribute $43.8 billion to U.S. GDP and generate $11 billion in tax and royalty revenue.”

He added, “These billions of dollars in benefits to local communities and the country at large highlight the important role U.S. LNG will play in growing our economy while reducing global emissions.”

Billions for schools, health go to industry instead

Louisiana’s residents are among the poorest in the country. The state ranks just ahead of last-place Mississippi on many qualify-of-life measures.

Hardest hit by the tax exemptions would be Cameron Parish, a coastal community in far southwestern Louisiana of about 4,700 people. Through ITEP, if all LNG facilities are built, Cameron Parish would forgo $14.9 billion in revenue between 2012 and 2040 from its local schools, police and health services, according to the report.

Four Texas LNG facilities would receive $2.1 billion in similar exemptions — a subsidy of about $4 million per job, the report says. In one example, the school district in Corpus Christi, Texas, is losing out on $762 million over a decade, which amounts to about two-thirds of the district’s annual budget. The report has similar breakdowns for all the communities where LNG terminals are proposed or located.

“As Donald Trump praises LNG export projects and vows to undo safeguards that protect people from the worst pollution, this report brings much-needed scrutiny to the practice of giving wealthy LNG corporations millions of dollars per job, which sacrifices tax revenue for infrastructure and services and ultimately damages the working class the industry claims to help,” a news release accompanying the report says.

The report was submitted to the Department of Energy to consider as it completes a study on whether LNG exports are in the public interest. Earlier this year, President Joe Biden paused approval of LNG terminals until the report is finished, although a judge has lifted that pause. That updated study, expected before the end of the year, is intended to be used by DOE to determine whether LNG can be exported to countries without free trade agreements with the United States.

Local officials mum on subsidies

None of the parish officials contacted by Floodlight in three Louisiana parishes affected by the exemptions responded to a request for comment. Plaquemines Parish, though, has been looking to attract more businesses to its community to replace revenue from oil and gas production that had dropped from $42 million in 2013 to just $9.5 million in 2024.

Venture Global’s Plaquemines LNG plant is scheduled to start operating early next year and is expected to provide the parish with hundreds of millions of dollars in sales tax.

But such promises are hollow for some who live near the LNG facilities.

LNG developers “come in promising the moon and stars and convince elected officials to hand out millions in corporate welfare, but all they deliver is a handful of jobs — far fewer than advertised,” said Cyndi Valdes, executive director of Ingleside on the Bay Coastal Watch Association in Texas.

“Economic prosperity is only found in corporate boardrooms and shareholder conferences out of town. The truth is that the middle class and our coastal environment pay big for these disgraceful tax breaks.”

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action.