Big utility PACs favor GOP in high-stakes 2024 races

While Republicans are the main beneficiaries, in the narrowly divided Senate, power companies hedged their bets with donations to some Dems

Investor-owned power companies in the United States made more than $10 million in campaign donations to state and congressional candidates running in the 2024 election, according to a new report by the Energy and Policy Institute, a utility watchdog.

Power companies and their political action committees (PACs) have funneled $13.6 million into federal campaigns as of Oct. 17, primarily directed at Republican candidates and committees.

This financial push underscores these companies’ efforts to secure regulatory environments favorable to their interests, often slowing the transition to green energy in the process. Even though cheaper, cleaner forms of energy are available — such as wind and solar — many U.S. power companies make billions primarily by burning climate-destabilizing fossil fuels.

On the local level, Floodlight has found that in the 10 states where public service commission regulators are elected, a significant portion — on average 35% — of donations are tied to utilities and fossil-fuel related interests.

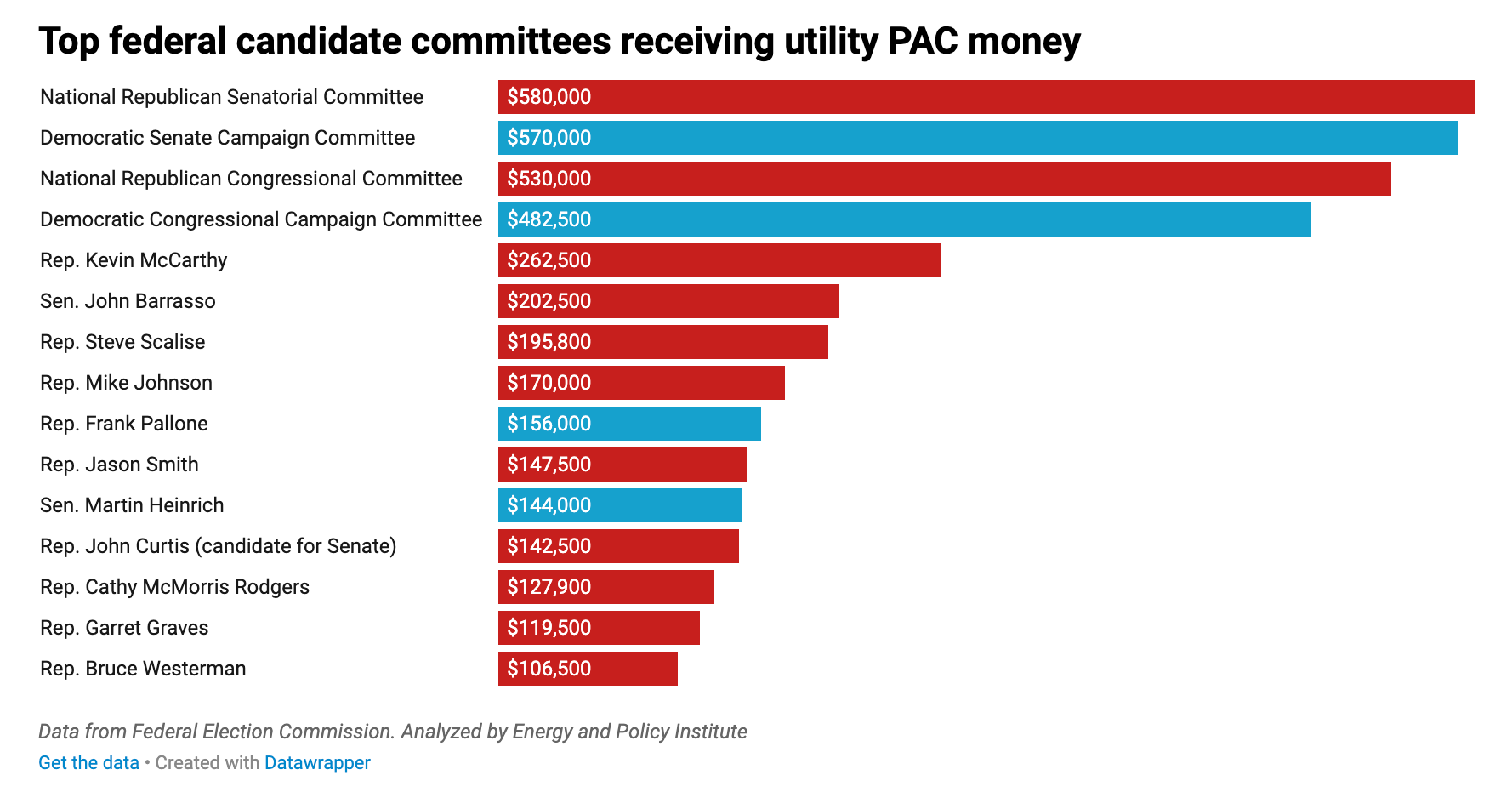

The report shows that utility PACs have allocated over $2.16 million to Democratic and Republican party campaign committees, with the majority going to GOP-aligned groups, the National Republican Senatorial Committee and the National Republican Congressional Committee.

Contributions from these PACs didn’t stop at party committees. Utility-related donations also flowed to powerful lawmakers whose positions could affect future energy and climate policy.

Notable recipients include former House Speaker Kevin McCarthy, R-California, who received the largest single amount at $262,500. Other top recipients were House Majority Leader Steve Scalise, R-Louisiana; House Speaker Mike Johnson, R-Louisiana, and Republican U.S Reps. Jason Smith of Missouri, and John Curtis of Utah, who is currently vying for a Senate seat. Smith is chairman of the powerful House Ways and Means Committee. And Curtis serves on the House Energy and Commerce Committee.

On the Senate side, utility PACs have favored Republican Sen. John Barrasso of Wyoming, and Democratic Sen. Martin Heinrich of New Mexico. Although neither face a tough re-election race, Barrasso is the ranking member, and Heinrich is a member, of the Senate Energy and Natural Resources Committee, which holds significant sway over the nation’s energy policies.

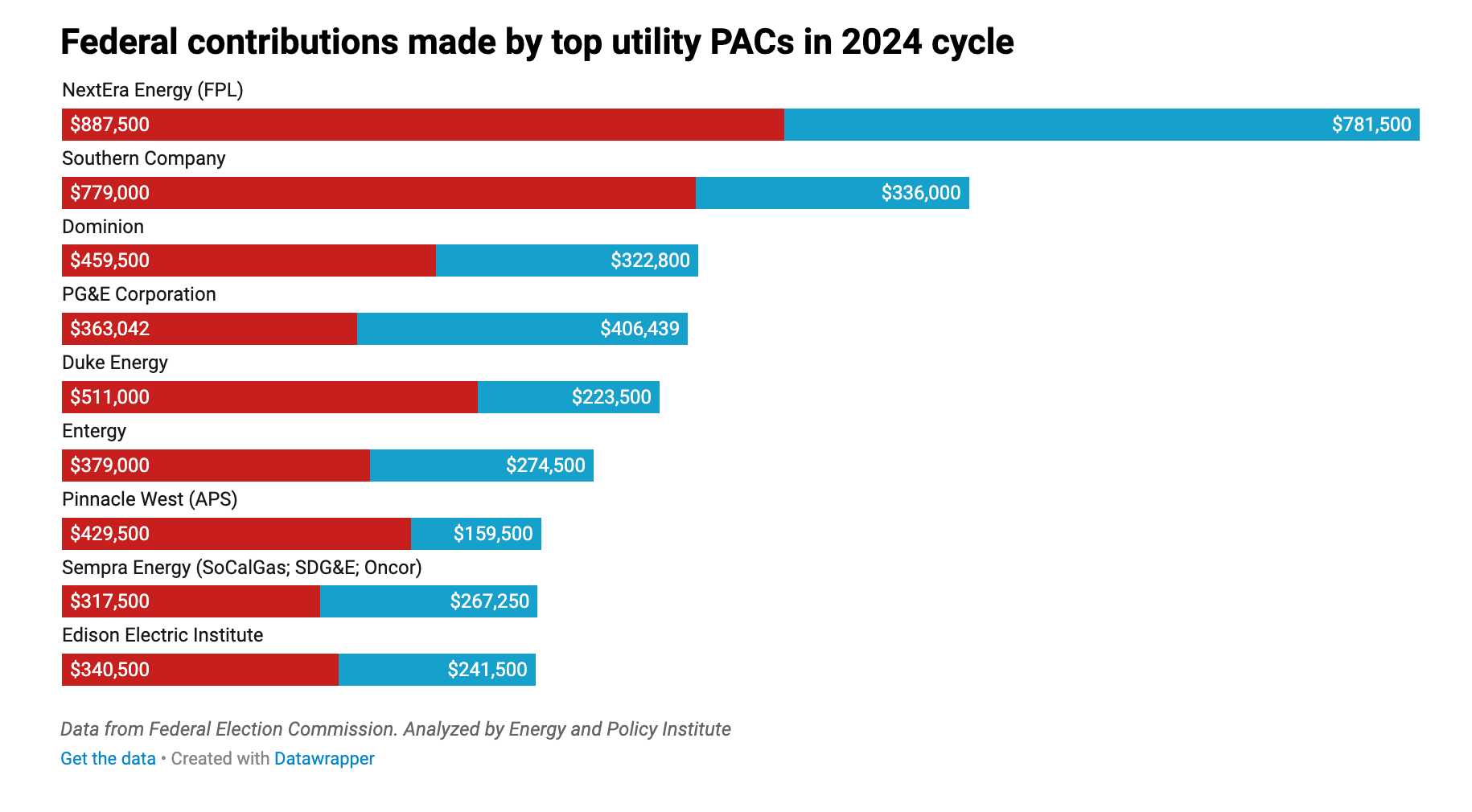

The top contributors this cycle have been some of the largest names in the utility sector: NextEra Energy, Southern Co., Dominion Energy, Pacific Gas and Electric and Duke Energy, followed closely by Entergy.

The top utility donor was NextEra, which spent $1.7 million on congressional campaigns, EPI found. NextEra is the country’s top generator of renewable energy. Florida Power & Light, its largest subsidiary, has been mired in a series of scandals involving its political influence over politicians in the Sunshine State.

These power companies have made consistent contributions not only to GOP party committees but also directly to Republican House candidates in races where the winner could tip the balance of control away from the GOP. A total of $472,770 has been directed to Republicans in these contested House contests, compared to a more modest $102,000 for Democrats.

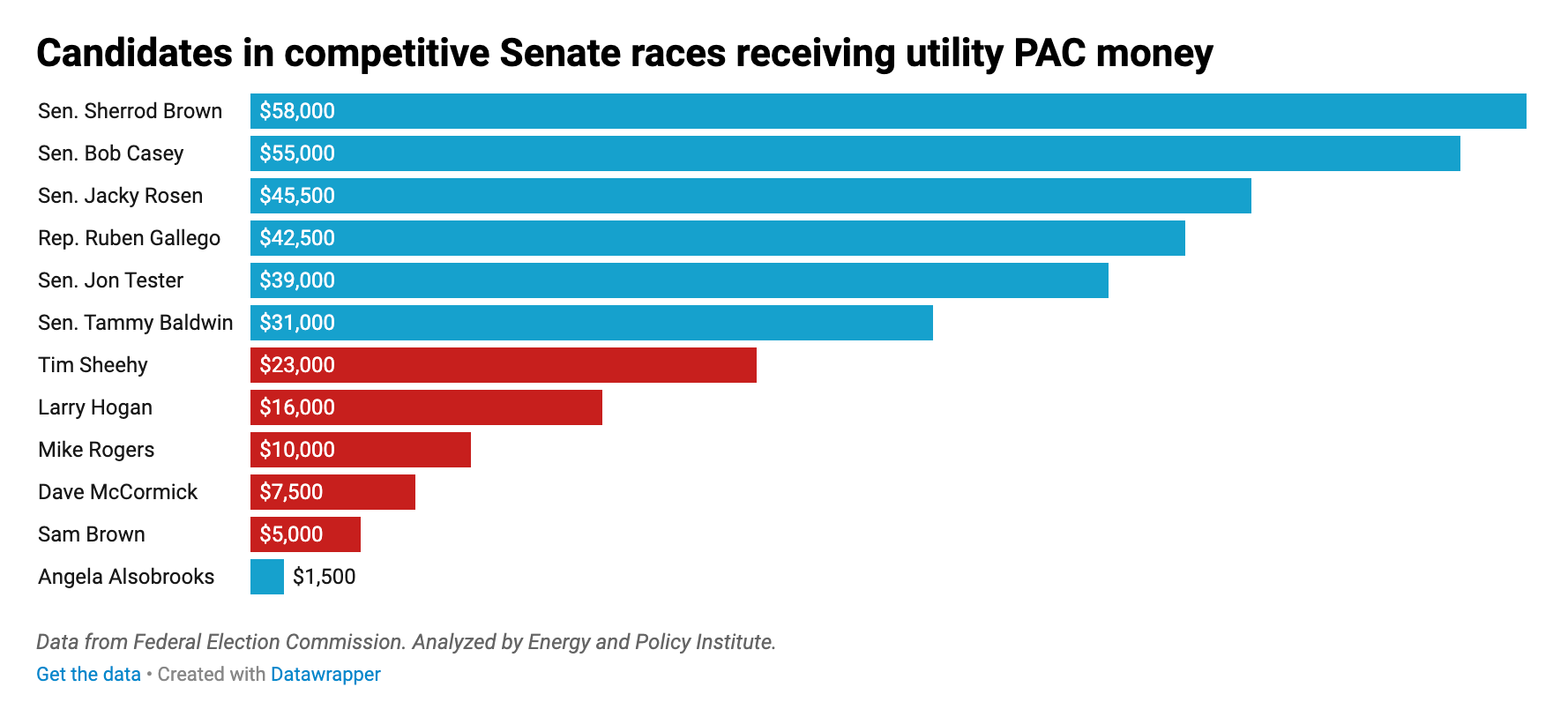

In contrast, when it comes to the Senate, utility PACs have hedged their bets slightly by supporting Democrats — who enjoy a tenuous two-vote majority in the Senate — in competitive races, a strategic approach meant to curry influence regardless of which party wins control this election.

One notable trend in this election cycle is the pullback in contributions from utilities recently embroiled in political scandals. Exelon and FirstEnergy, for example, have significantly reduced their giving to federal committees, with Exelon cutting contributions by 57% and FirstEnergy by 23% compared to 2020, according to the EPI report.

These reductions come amid increased scrutiny over the influence of these companies in certain state legislatures, putting pressure on them to scale back their visible political involvement.

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action.