Will bitcoin and data centers risk US climate goals?

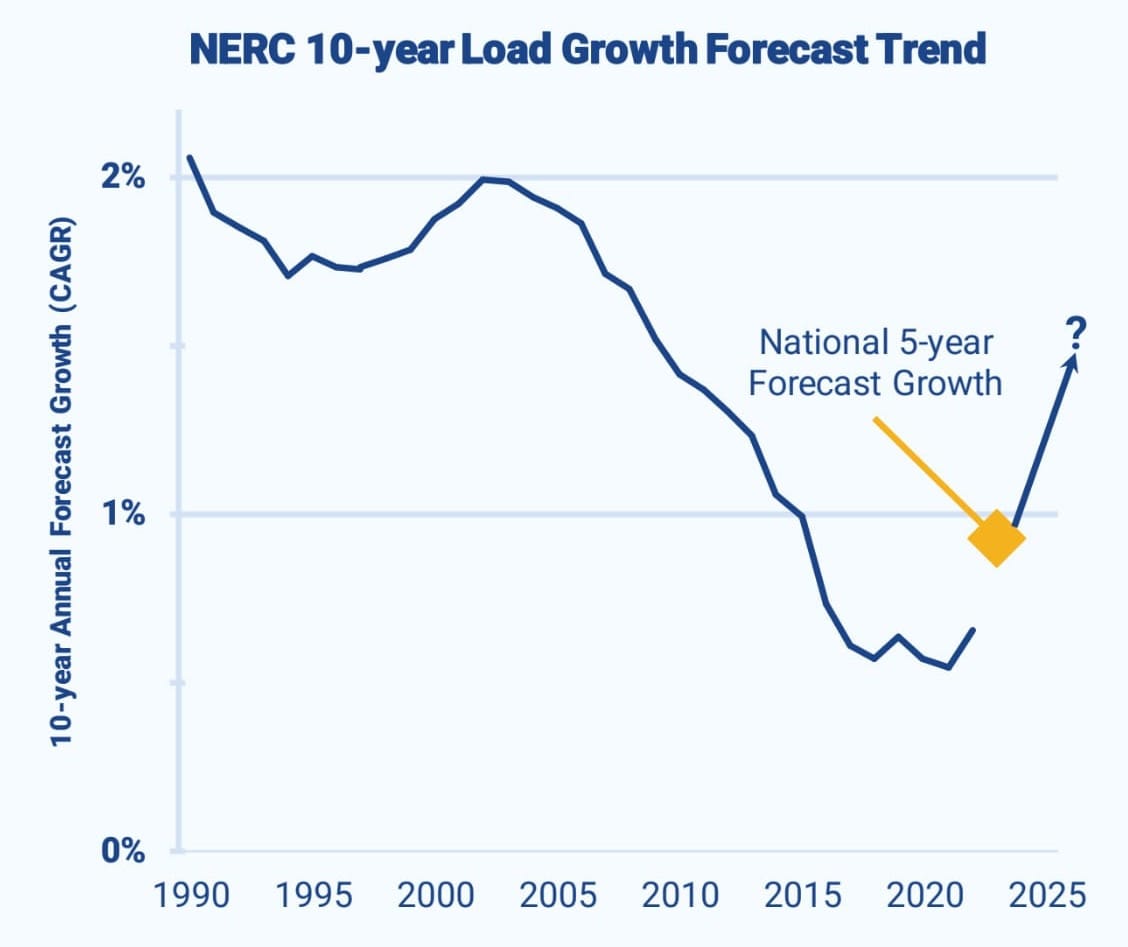

US energy use has been flat. But new industries are forcing a boost in utility forecasts for demand, potentially harming efforts to cut emissions.

Published in Canary Media, Energy News Network, Louisiana Illuminator

The United States is facing a new energy crisis — one that could make the climate crisis even worse.

After more than 30 years of falling or flat demand for electricity, electric utilities are forecasting the nation will need the equivalent of about 34 new nuclear plants, or 38 gigawatts, over the next five years to supply power for data centers, electrification and new industry, according to filings made to the Federal Energy Regulatory Commission and compiled by Grid Strategies.

Since those reports, several utilities have further increased their near-term forecasts.

And those estimates don’t necessarily include the growth of hard-to-track, but energy-hogging crypto currency or cannabis farming, which are estimated to be using up to 2.3% and 1%, respectively, of the nation’s electricity. Energy demand in these industries has skyrocketed as the popularity of crypto currency and the legalization of marijuana have spread.

The utilities “were either just caught unaware or not believing what they were hearing,” said Rob Gramlich, president of Grid Strategies, which provided a cumulative look of the demand in December.

In response to this demand, which seems to have power providers in the United States flat-footed, many utilities want to build new power plants to burn methane, a fossil fuel also known as natural gas, or to delay closing their coal plants.

“I can’t recall the last time I was so concerned about the U.S. energy trajectory, as major utilities maneuver for mass gas capacity expansion in the face of load growth. Unless course is changed … (greenhouse gas) goals are effectively dead,” Tyler Norris, a doctoral fellow at Duke University, said in a recent tweet.

The issue is also a global one, as a recent International Energy Agency report says electricity for data centers, including for AI and cryptocurrency, could double by 2026.

At the same time, there hasn’t been enough construction of enough new transmission to bring renewables such as solar and wind to the grid.

“We see (the gas buildout) as a huge threat — we are at a moment where we need to be phasing out fossil fuels and not locking it in for decades longer,” said Gudrun Thompson, energy program leader for the Southern Environmental Law Center.

2022 projections ‘were so off’

Norris said in 2022 he pointed out in hearings on Duke Energy’s carbon plan that the company seemed to be “low-balling” the need for more electricity, including for the growing amount of electric vehicles. At about the same time, Georgia Power told regulators it only needed the equivalent of one more mid-sized power plant to meet growth for the rest of the decade after its two new nuclear units at Vogtle came online.

But late last year, Georgia Power said it will need 17 times more electricity — the equivalent of four new nuclear units — than what it had forecast just 18 months earlier because of new data centers and manufacturing in this state.

One Georgia Public Service Commissioner, known for backing Georgia Power, questioned whether the company should have seen that growth coming ahead of time.

“Talk with me about why I should have any confidence whatsoever in these projections when the 2022 projections were so off,” a heated Tricia Pridemore asked in a PSC hearing.

Economic development interests in the state call the demand a measure of success. Georgia Gov. Brian Kemp has aggressively recruited new industry to the state, and its economic development arm and Georgia Power tout low electricity prices there as a way to attract that industry.

The same is true in Texas, where data mining centers have requested the equivalent of roughly 41 new nuclear power plants to power their energy-intensive computer processes to find the cryptocurrency.

Virginia cools on data centers

In Virginia, data centers are no longer as welcome as they once were. Dominion has threatened to turn away new centers, saying it can’t meet the power demand.

The utility said in 2023 that demand for electricity from those centers would increase 376% by 2038. Even if that demand is tempered, Dominion still expects overall demand for power to grow by 85% over the next 15 years as consumers shift to electric appliances, heating and cooling units and vehicles.

The Tennessee Valley Authority is also a hotspot for new data centers, with 65% of its new load growth since 2019 coming from data centers. TVA has contracts from additional centers not yet online that will increase its load another 40% to 50%. The quasi-public utility has proposed or is building eight new natural gas plants to fill the demand.

“The timeframe that they can get online has been aggressive on their part,” said Lori Stenger, TVA’s director of enterprise, forecasting and financial planning.

This underscores one point made by observers: Data centers and data miners aren’t just going to places where power is cheap, but where they can get power the fastest. In fact, some crypto miners are purchasing coal plants to provide electricity for their operations.

Utilities say they can’t meet the skyrocketing growth with wind, solar and other renewable energy, but a large group of businesses including Google and Microsoft, beg to differ. The 400-member Clean Energy Buyers Association said fossil fuels are not aligned with their goals.

“Georgia Power’s proposals to add more fossil fuel resources into its resource mix in this docket send the wrong message to the business community and large customers evaluating Georgia as a place to do business,” said Priya Barua, CEBA’s director of market and policy innovation, in written testimony over Georgia Power’s request to add more capacity.

Data on crypto energy use lacking

Despite the utility’s forecasts, it’s still unclear exactly how much power is needed.

Jeremy Fisher, a principal advisor for climate and energy with the Sierra Club, said while data centers in Northern Virginia are using roughly the equivalent of three nuclear plants worth of energy, the centers themselves are building almost four times that much in backup diesel generation around their centers, according to a review of permitting data. The backup power could be an indication those centers are preparing for future growth, Fisher said.

“There’s such little data, it’s frustrating,” said Mandy DeRoche, a lawyer at Earthjustice who has been tracking data centers.

That lack of clarity around the nation’s electricity use — no single agency has a full picture of how much is needed or used — was in the spotlight this year after the federal Energy Information Administration sent an emergency request to crypto currency miners requiring them to share how much electricity they use.

Texas miners sued to stop the request, and the EIA has agreed to go through a more formal process that will take longer to gather that data.

At least one publicly traded Bitcoin miner, Riot, which sued the EIA to stop the data collection, highlighted the risk of such data becoming public in its annual report to the Securities and Exchange Commission last year.

“It is possible that mandatory surveys such as this will be used by the EIA to generate negative reports regarding the Bitcoin mining industry’s use of power and other resources, which could spur additional negative public sentiment and adverse legislative and regulatory action against us or the Bitcoin mining industry as a whole.”

Floodlight depends on a community of readers like you who are committed to supporting nonprofit investigative journalism. Donate to see more stories like this one.