Utilities to spend billions to power AI. Are they jumping the gun?

Chinese AI tech DeepSeek is forcing a second look at proposals to build a record number of new fossil fuel power plants

Published by the Louisiana Illuminator

A new artificial intelligence model from China not only upended stock markets this week, it also called into question whether the rush to build new, mostly fossil-fueled power plants to run data centers is premature.

The new AI model from China, DeepSeek, uses less power and cheaper computer chips than the AI technologies currently in broad use in the United States, according to the Chinese company and analysts.

“There is a reason electricity stocks fell alongside tech stocks yesterday,” said Logan Atkinson Burke, executive director of the Alliance for Affordable Energy. “The news of more efficient AI means the plans and promises for unlimited load growth from AI points to the likelihood that energy needs have been overstated.”

The Alliance is a utility watchdog in Louisiana tracking the development of what would be one of the state’s larger power plants to provide energy to a massive Meta data center proposed for north Louisiana. The cost of the center, pegged by Entergy Louisiana in state regulatory documents as at least $5 billion, was announced later as a $10 billion project.

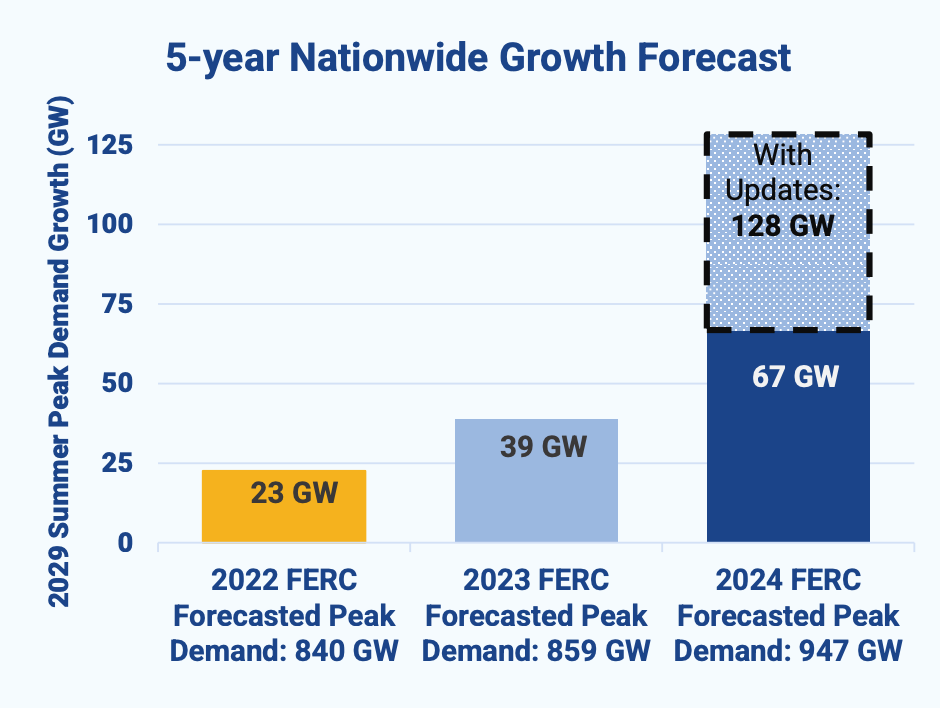

A recent U.S. Department of Energy study found that by 2028, data centers could consume 12% of the nation’s power — they currently use about 4%. A significant percentage of that power would be for artificial intelligence.

Up to 50,000 megawatts (MW) of new electric generation could be needed by 2030 to power this data center boom, according to an analysis by S&P Global. That’s an amount that could thwart the move to fight climate change, activists worry.

But if data centers switch to a more energy efficient technology, like DeepSeek, residential and other customers could be left paying for new energy infrastructure that is not needed, consumer advocates say.

In Virginia, North Carolina, South Carolina and Georgia alone, utilities are planning to build more than 20,000 MW of natural gas power plants by 2040 — roughly the same amount of electricity that all of South Carolina uses during its summer peak — according to a new report by the Institute for Energy Economics and Financial Analysis. IEEFA says more consumer protections are necessary so data center operators can’t walk away from a power plant built for its use.

The concerns aren’t just hypothetical. In early January, Microsoft said it was pausing construction of its $3.3 billion data center in Wisconsin to evaluate recent changes in technology.

When Floodlight asked whether Microsoft is considering Chinese AI development or other more efficient models, the company declined to answer. Meta didn’t respond to a question about whether DeepSeek or similar technology could alter its plans for Louisiana.

“We have all these forecasts for significant growth, and obviously we're going to start building as if those forecasts are certain,” said Savannah Wilson, an energy policy analyst with Clean Virginia, a utility watchdog group. “But with a new advance like this, it's very easy for that to suddenly change, and then to have all these pieces of infrastructure that have been built that you may no longer need, because all of a sudden your systems are more efficient.”

Wilson spoke during a recent webinar that addressed the hidden costs of data centers — including energy, water and land — that are increasing as big tech’s demand for such centers has skyrocketed in the past year.

Utilities and regulators in Indiana and Georgia have enacted safeguards to protect ratepayers, while Duke Energy, which operates in six states, will require a minimum payment from data center operators, regardless of how much energy they use.

Davante Lewis, a commissioner of Louisiana’s utility regulatory body, said he appreciates the measures already put in place between Meta and Entergy Louisiana to build 2,200 MW in natural gas generation for Meta’s data center. Meta, for instance, has agreed to pay for much of the necessary electric transmission for the project to protect consumers. But Lewis says he still has questions about the deal, which the commission is expected to approve this year.

The development of DeepSeek has heightened his concerns. He wants to know that if Meta leaves Louisiana, the cost of the additional gas plants and transmission lines “doesn't get spread around to other people in the rate base.” Lewis added, “The announcement of new emerging technology only enhances those questions.”

Meta has committed to taking power from the new natural gas power plant for 15 years, but Lewis noted the lifespan of a natural gas power plant is usually 30 years.

A research note from investment and financial firm Jefferies said DeepSeek’s success could go two ways: Either drive the industry to “pursue more computing power to drive even faster model improvements” or “refocus on efficiency … meaning lower demand for computing power as of 2026.”

For now, prominent climate activist Bill McKibben sees the introduction of DeepSeek as a potential climate win.

Writing in his weekly newsletter, McKibben said: “The increasingly gloomy idea that there was no possible way we could ever deal with climate because AI would soak up every new electron that sun and wind could ever provide may not be quite as true as it seemed to some a week ago.”

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action.