Fraud and corruption on rise at US utilities, threatening energy transition

A Floodlight analysis finds a historic surge in power company fraud and corruption. The lies and bribes cost consumers — and threaten the planet.

Published in Mother Jones and the Ohio Capital Journal

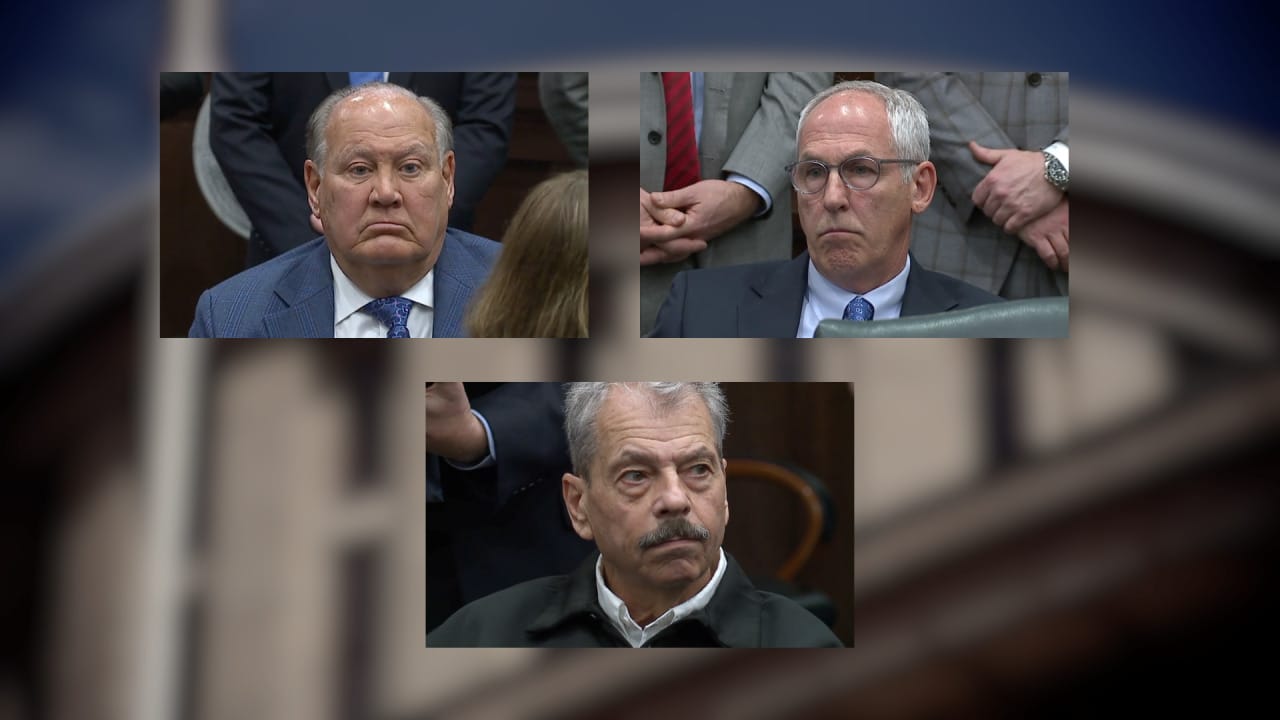

On Feb. 12, Ohio Attorney General David Yost accused two power company executives of attempting to “hijack” state electricity policy for their own corrupt ends by bribing an energy regulator with over $4.3 million. The executives are accused of trying to bilk $1.2 billion from electricity customers on behalf of their former employer, FirstEnergy.

Flanked by sheriffs and attorneys, the grim-faced Yost said the charges are just the latest indictments in an ongoing criminal probe into the lobbying practices of Ohio power companies.

Former Ohio Public Utilities Commission Chairman Sam Randazzo had been indicted previously by the Department of Justice, accused of working secretly with executives for more than a decade to secure favorable regulations for FirstEnergy — which pleaded guilty to federal fraud charges in 2021 for its role in the scandal.

Last year, three lobbyists, along with former Ohio House Speaker Larry Householder, pleaded guilty to or were convicted of federal racketeering charges. (Faced with the prospect of years in prison, one of the lobbyists took his own life.) Another utility operating in Ohio, American Electric Power, is under investigation by the Securities and Exchange Commission.

“Power is inherently seductive and corrosive,” a somber Yost noted after laying out the latest alleged plot.

The Ohio scandals are no fluke. They are part of a generational resurgence of fraud and corruption in the utility sector, according to a Floodlight analysis of 30 years of corporate prosecutions and federal lawsuits. And it comes at a time when trillions of dollars and the health of the planet are at stake as some power companies embrace — or seek to block — the transition away from fossil fuels toward wind, solar, hydrogen and nuclear, which produce fewer greenhouse gasses.

Over the past five years, at least seven power companies have been accused of fraud or corruption. Seven industry executives have pleaded guilty or been federally indicted, along with a handful of appointed and elected officials. And a growing number of industry shareholders have sued the companies, claiming executives lied about their alleged misdeeds.

Utility fraud and corruption — in Florida, Illinois, Mississippi, Ohio and South Carolina — have cost electricity customers at least $6.6 billion, according to Floodlight’s analysis. Ratepayers have bankrolled nuclear plants that never got built, transmission systems that were over-engineered to beef up profits, and aging coal facilities that couldn’t compete with cheaper ones powered by methane, which the industry calls natural gas.

Like waiters with a guaranteed tip, many power companies operate as state-sanctioned monopolies that collect government-guaranteed returns on their investment. The companies increase returns by building new power plants and transmission lines — and jealously defending their turf, even if it hurts consumers and the environment.

“I’m actually flummoxed by why the (utility) CEOs and executives would revert to corruption,” said Mark Toney of the Utility Reform Network, “when the record is, you can make so much more if you’re focused on just running the scam that it is.”

Most experts agreed that the current situation arises from a mix of poor regulation and the weakening of Depression-era safeguards meant to rein in rapacious monopolies. Electric companies have always aggressively pushed their own profit-making agendas before state regulators. But now, some are getting caught breaking the law in the process.

“The only real customer for the utility company is the regulator,” said Mike Jacobs, a senior energy analyst at the Union of Concerned Scientists. “The scariest part of this wave of utility scandals is what we don’t know: How many utilities have committed crimes that prosecutors haven’t noticed?” said David Pomerantz, executive director of the Energy and Policy Institute, a utility watchdog.

“What about schemes that didn’t break any obvious laws, but extracted more money from customers every month only to pad utility profits, without improving service?” he added. “The only way we’ll ever know the answers to these questions is if regulators crack open utilities’ books and emails and investigate.”

A spike in corruption

The last time there was this much turmoil in the power industry, you could still rent DVDs at Blockbuster.

Back in the early 2000s, the California energy crisis was triggered by less-than-honest gas and electricity traders, including the infamous Enron company. The companies that employed these traders gamed newly-created power markets by placing fraudulent energy trades and even causing blackouts as a way to artificially and dramatically raise the cost of energy to enrich themselves.

The tumult reached its peak in 2002, when six industry executives were indicted for a variety of fraudulent schemes, and seven shareholder suits alleging fraud were filed against energy companies.

The issue of fraud and corruption is more critical now as the nation transitions to a cleaner energy future, and power companies project spending billions of dollars to launch projects like offshore wind and nuclear power and shut down older fossil fuel plants.The International Energy Agency projects that annual capital spending will increase from $2.8 trillion globally last year to more than $4 trillion in 2030.

But behind the scenes, utilities have resorted to a wide range of tactics to block the energy transition — even, in some cases, fraud and corruption. “I think because of the importance of climate change, the stakes are much higher,” said Steve Cicala, an economics professor at Tufts University who studies the sector.

Power companies have led cuts in U.S. emissions so far. Total U.S. emissions are down roughly 17% from their 2007 peak as power companies shuttered coal plants in favor of methane and renewables. But the sector still has a long way to go if it is going to meet targets in the Paris Agreement on climate change.

Fraud and corruption, Wall Street analysts warn, could cause a short-circuit, prompting mistrust among consumers and investors, whose support is needed to pay for the shift to a cleaner energy future.

“When investors see that executives have misled either consumers or regulators,” said Travis Miller of Morningstar Research Services LLC “they get nervous about what else executives might be doing to mislead investors.”

In six lawsuits, shareholders have claimed losses of over $12 billion over the past five years due to alleged power company fraud and corruption. So far, three companies have paid out half a billion in settlements.

Brian Reil, spokesman for the Edison Electric Institute, the group that represents investor-owned U.S. electric utilities, said he sees no cause for concern.

“Our member companies are highly regulated entities at both the federal and state levels, and in the limited instances where there has been real evidence of wrongdoing, we have relied on the proper authorities to do their work,” Reil said.

The scandalous seven

Federal prosecutions of white collar crimes of all kinds are at historic lows. The number of shareholder suits have returned to historically average levels after peaking in 2019. Yet in the past five years, seven power companies have become embroiled in scandals involving alleged fraud or corruption.

In Ohio, officials began investigating FirstEnergy and AEP after state lawmakers passed House Bill 6. That bill gutted the state’s energy efficiency standards, bailed out FirstEnergy’s struggling nuclear plants with $1.2 billion in taxpayer funds, and propped up AEP’s coal plants with a $243 million subsidy.

FBI agents discovered that FirstEnergy had donated more than $60 million in dark money to groups controlled by Larry Householder, then-Ohio House speaker, in exchange for passing the bill. The company pleaded guilty in 2021 and has been cooperating with investigators.

Court records also show that AEP, which has not been charged, donated at least $500,000 to a Householder-related group. Householder was sentenced to 20 years in federal prison in 2023. He is appealing the ruling, claiming the bribe payments are within his first amendment rights.

In Illinois, Commonwealth Edison admitted in 2020 to bribing Mike Madigan, Illinois’ longest serving House speaker, with no-show jobs for his political supporters. In exchange, Commonwealth Edison got at least two favorable bills passed through the state Legislature, and one unfavorable bill killed — benefits the SEC says totaled more than $150 million. The laws allowed the power company to spend extravagantly — and some say unnecessarily.

“We're going to be paying for 10 years of gold plating (transmission lines) — that came out of a corruptly passed law — for years to come,” said Sarah Moskowitz, executive director of the Citizens Utility Board of Illinois.Two Commonwealth Edison executives pleaded guilty last May.

Madigan’s federal trial is set for October. The company has paid over $450 million in fines and settlements arising from the scandal. In Florida, two executives of the Jacksonville Electric Authority are on trial on charges of wire fraud after the pair were caught crafting a golden parachute that would pay them “exorbitant funds” upon the sale of the municipal utility to a private company.

The likely buyer? Palm Beach County-based NextEra Energy. In a lawsuit, shareholders have accused NextEra of lying about a job offer its consultants arranged for a Jacksonville city commissioner who was a presumptive “no” vote on the sale.

The suit also claims that the same consultants supported third-party “ghost” candidates with hundreds of thousands of dollars of dark money in four state Senate elections at the behest of the power company. NextEra disputes the allegations and has filed a motion to dismiss the suit.

A Mississippi whistleblower, meanwhile, filed a lawsuit that accuses Southern Co. of stealing $382 million from the federal government during a failed $7.5 billion attempt to build a coal gasification plant there. The company already paid another whistleblower an undisclosed amount in 2016, and settled a related shareholder suit for $87.5 million in 2020.

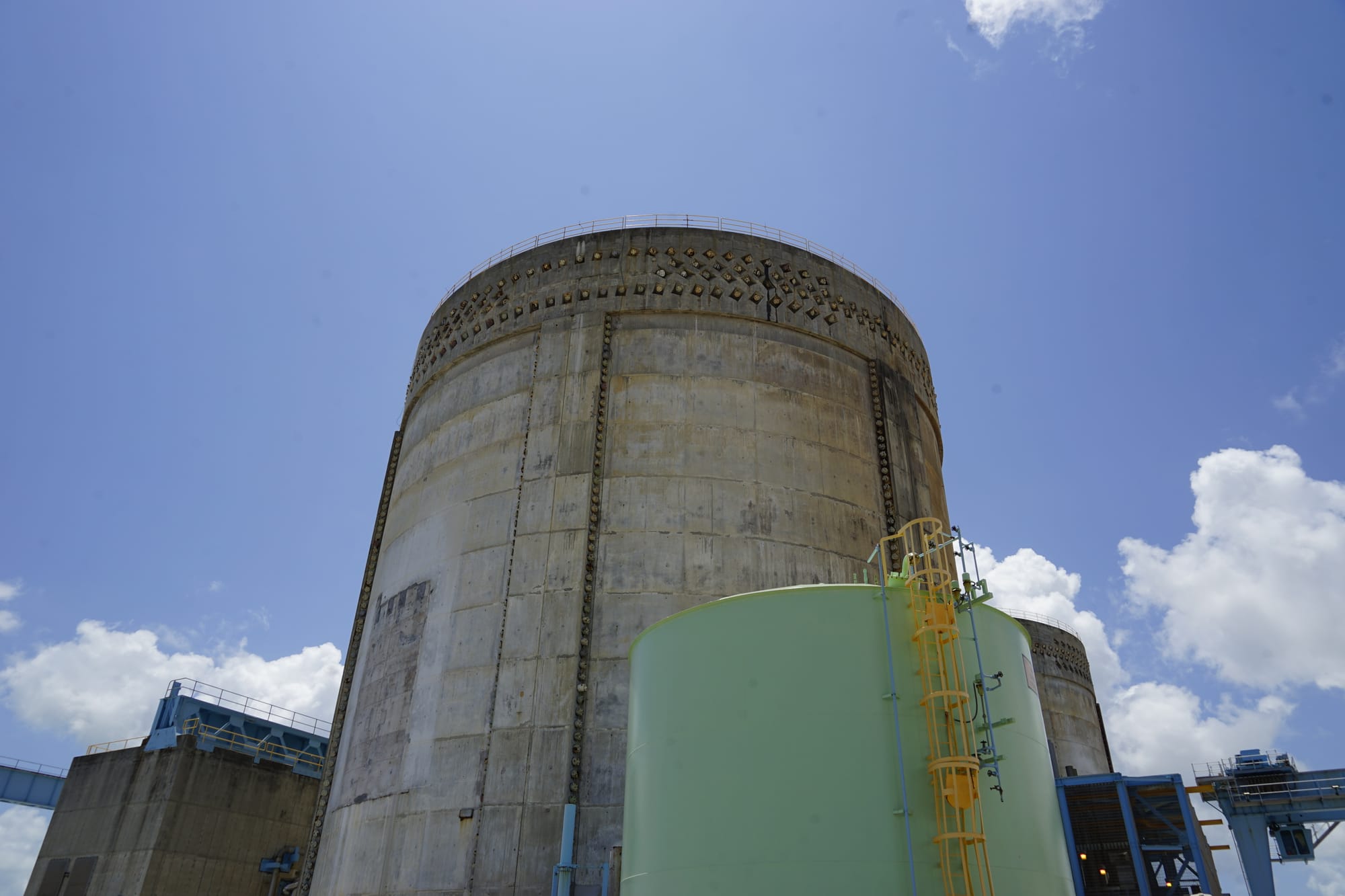

And in South Carolina, the former CEO of SCANA Corp. was sentenced in 2021 to two years in federal prison for defrauding ratepayers during the failed construction of a nuclear reactor in that state. The debacle cost ratepayers $3.8 billion.

Rules loosened in early 2000s

More than a century ago, privately owned utilities helped create the current regulatory system in which appointed or elected commissions review utility expenditures and proposed rate increases. The utilities pushed for state-level regulation as they sought ways around irregular local rules.

By the 1920s, said Virginia Tech technology historian Richard Hirsh, the industry had grown effective at capturing and manipulating regulators, leading them to make decisions that helped the utilities’ bottom lines instead of the public interest. And the majority of the industry’s assets had fallen into the hands of a few highly leveraged holding companies.

“So the Federal Trade Commission in 1928, through about 1933 or so, pursued these investigations of utility companies and uncovered some of these abuses and made them public,” Hirsch said.

The FTC investigations culminated in the 1935 passage of the Public Utility Holding Company Act, a core plank of Roosevelt’s New Deal. The act splintered the holding companies and gave the federal government more control of the industry.

The establishment of the Federal Energy Regulatory Commission in 1977 led to further transparency. The agency required utilities to file yearly expenditure reports where they disclosed political giving and lobbying and contractor relationships.

That line-by-line reporting stopped in 2002, as FERC switched from paper to digital records.

And in 2005, Congress undid other core provisions of the public-utilities law, allowing holding companies to once again concentrate both their market and political power. The Supreme Court’s 2010 decision in Citizens United, which helped pave the way for unrestricted, untraceable spending in the political arena, only served to increase utility influence in politics.

“The repeal of PUHCA is definitely a major contributing factor to some of the problems we’re seeing today,” said Tyson Slocum, director of Public Citizen’s Energy Program. “It turns out that the lessons that Congress learned during the Great Depression and the collapse of the market, the collapse of many of our economic systems, were proven right.”

Floodlight depends on a community of readers like you who are committed to supporting nonprofit investigative journalism. Donate to see more stories like this one.